Learning from the Terra Luna Fiasco

Where were you during the great Terra Crash of 2022?

I was just a bystander watching the catastrophe unfold on Twitter. The Crypto community went through every stage of grief.

This can't be happening! We demand our money back, no matter the cost! Is there anything we can do to stop this? I can't believe I've lost my life's savings. I have to move on from this.

More than anything, this fiasco has reminded me that when we stray from logic and embrace emotions during decision making, we can get very badly burned.

In this piece, I'll be outlining the 5 lessons I learned about investing in Crypto as I scoured through hundreds of Tweets during the crisis.

I won't dive into how or why it happened since it's been widely documented and there's still some doubt behind there being an "attacker". You can check out CoinDesk's Analysis on the crash for more information or watch CoffeeZilla's breakdown.

Lesson 1 - Don't invest more than you can afford to lose

Common sense: don't invest your rent payments, your life's savings, or money you've borrowed from someone else.

Yes, you can earn more if you invest more, but IT'S NOT WORTH IT if the downside risk means not just losing your money but also your livelihood, relationships, and peace of mind.

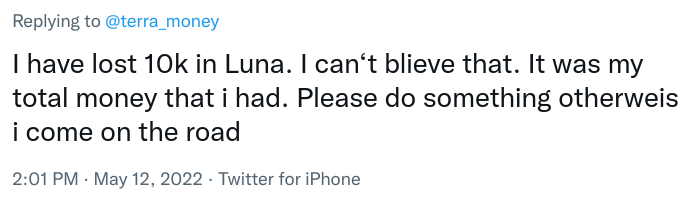

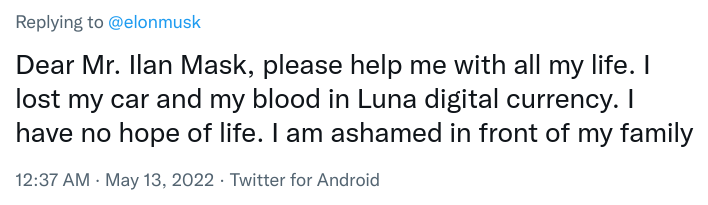

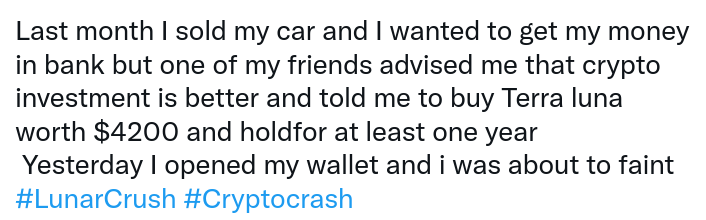

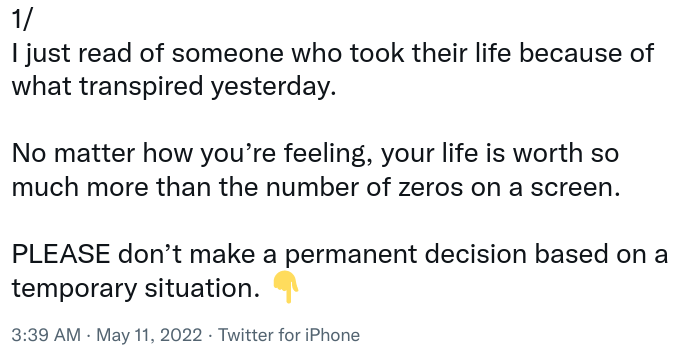

These screenshots below were taken from Twitter. I've removed the display names and usernames to protect each person\'s privacy.

Lesson 2 - If it's too good to be true, it probably is

The Anchor Protocol promised returns of \~20% for depositing UST. This is incredibly high compared to traditional finance (or TradFi). Moreover, borrowing rates were much lower. Approximately 10% according to one report

Naturally, this begs the question: how is this system sustainable? If they're not earning enough from borrowings to repay their depositors (and assuming they can't meet the shortfall from staked collateral alone), how are they guaranteeing their advertised returns?

I'm still wrapping my head around a lot of Crypto technobabble, but according to what I've read this was not meant to be a long-term offering. It was a customer acquisition play and their debt obligations were met through a combination of using their reserves and relying on the speculative value of LUNA. They were propping Anchor up artificially.

It was a short-term "too good to be true" offering that unfortunately unravelled before it could evolve.

The whole thread above is worth a read.

Lesson 3 - Don't put your faith in arrogant founders

I haven\'t been following Terra for long so I have no idea if Do Kwon (its founder) was arrogant from the get-go or whether he became arrogant over time as his projects did well.

He became known for calling his critics "poor". He said there'd be entertainment in watching 95% of Crypto companies fail.He had earned his "FU Money" and was clearly letting people know.

I get that being cheeky and snarky are what people love on Twitter, but he seemed to have been blinded by his arrogance and overconfidence. He was warned about a potential vulnerability but instead of addressing concerns, he challenged billionaires to disrupt his project using a method that would reward them handsomely if it worked.

That seems like a breach of fiduciary duty to me, regardless of whether or not it was the same method used to start the death spiral of UST and LUNA.

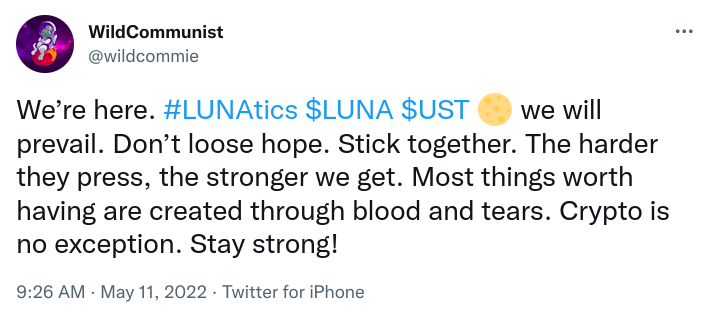

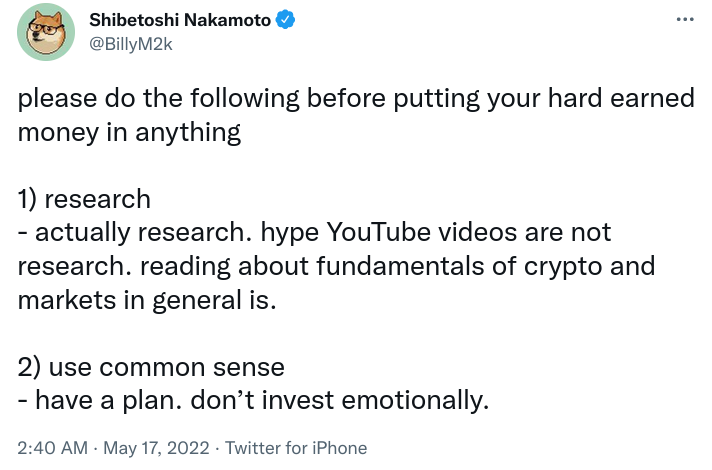

Lesson 4 - Invest based on logic and facts, not emotion and beliefs

"We believe in \$SOMECOIN" is not a reason to buy. "Stay strong" is not a reason to hold.

It's easy to get swept up in the emotions of a community. Especially one that's as loud and boisterous as the Crypto community. But if the only reason you're investing is that several anonymous people on a Discord server told you that \$SOMECOIN is the next biggest thing, you're basically lifting your legs as they place the rug under your feet. Or you're unwittingly taking part in their pump-and-dump scheme where you'll most likely lose out on your investment before you can dump.

DYOR or Do Your Own Research always. If there's not enough information online, be skeptical. If you don't understand their Cryptobabble, be skeptical. If the founders are anonymous or haven't disclosed their experience and credentials, be skeptical. If their community seems like a cult, be skeptical.

If it's too good to be true, remember Lesson 2.

Lesson 5 - The Crypto community still has a lot to figure out

Cryptocurrencies and Blockchain are still emerging technologies, with (in my opinion) a lot of unanswered questions.

Are algorithmic stablecoins actually feasible? Are fiat-backed stablecoins truly resistant to similar attacks? How do we measure the fair market price of a coin? Is there a point to technical analysis if so much is based on "hype" and emotions?

There's a lot of work that needs to be done and undoubtedly, a lot more risks the community will need to take. But until we're at a point where we've figured things out, remember that this is a largely unregulated space.

You're on a boat, the seas are rough, and you don\'t have a life jacket. Make your decisions accordingly.